Once their card details are entered, they hit the confirm button, and the payment processing method is initiated. Using the same scenario as above with the eCommerce merchant, let’s say the customer inputs credit card information when they process their transaction through the checkout.

DEBIT CREDIT CARD PROCESSING SOFTWARE

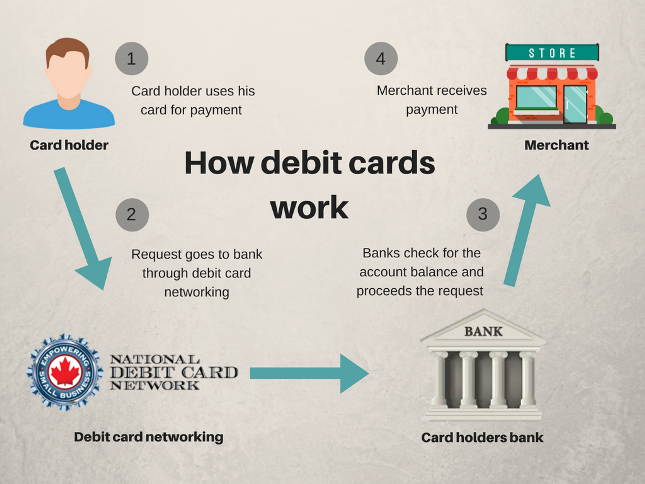

They click on the checkout button and are presented with payment options… A customer has selected items they wish to buy from you, they’ve been moved to their shopping cart, and they’re ready to check out through the payment gateway. Let’s say you’re an eCommerce business owner. The system that enables this is the payment processing technology and provider. Attached to the consumer’s checking account, these payments move directly from the user’s bank to the merchant’s. Learn More What is Debit Card Processing?ĭebit card processing, in a nutshell, allows businesses to accept debit card payments. To that end, below is a detailed guide to help you understand debit card processing, debit card processing fees, and the smart implementation of debit card processing solutions. But to find effective payment processing solutions, merchants should also have all the right information regarding debit card processing. Credit cards, comparatively, made up 27 percent.ĭespite the popularity of debit cards, much of the payment-centric content out there tend to center around credit card payments. The Federal Reserve’s annual “Diary of Consumer Payment Choice” in October 2021 found that debit cards are the most used payment method, making up 28 percent of total payments among the consumers studied. but believe it or not, the debit card remains the most popular. Credit cards are very much a part of typical life in the U.S. According to a 2022 study cited by CNBC, the average American has four of them. Credit cards are abundant in the United States.

0 kommentar(er)

0 kommentar(er)